Strategic Investments & Advisory

Building the Future of Logistics, Supply Chains, and Infrastructure through Investments and Advisory.

Our Strategic Investments & Advisory Practice

LPX is the strategic investment arm of Logistics Plus, backed by the network’s global footprint across 45 + countries. We review opportunities in both developed and emerging markets and invest across the capital spectrum—from Seed ($250 k) to opportunistic private equity. Larger growth deals are executed alongside strategic co-investors, giving founders not just capital but embedded access to a global network of experts & partners.

Our Focus Areas

Early-Stage

We back founders who are redefining how the world moves goods, data, and capital. Our focus is on solutions that:

- Rewire global supply chains in response to the post-2020 shift in trade flows and sourcing models.

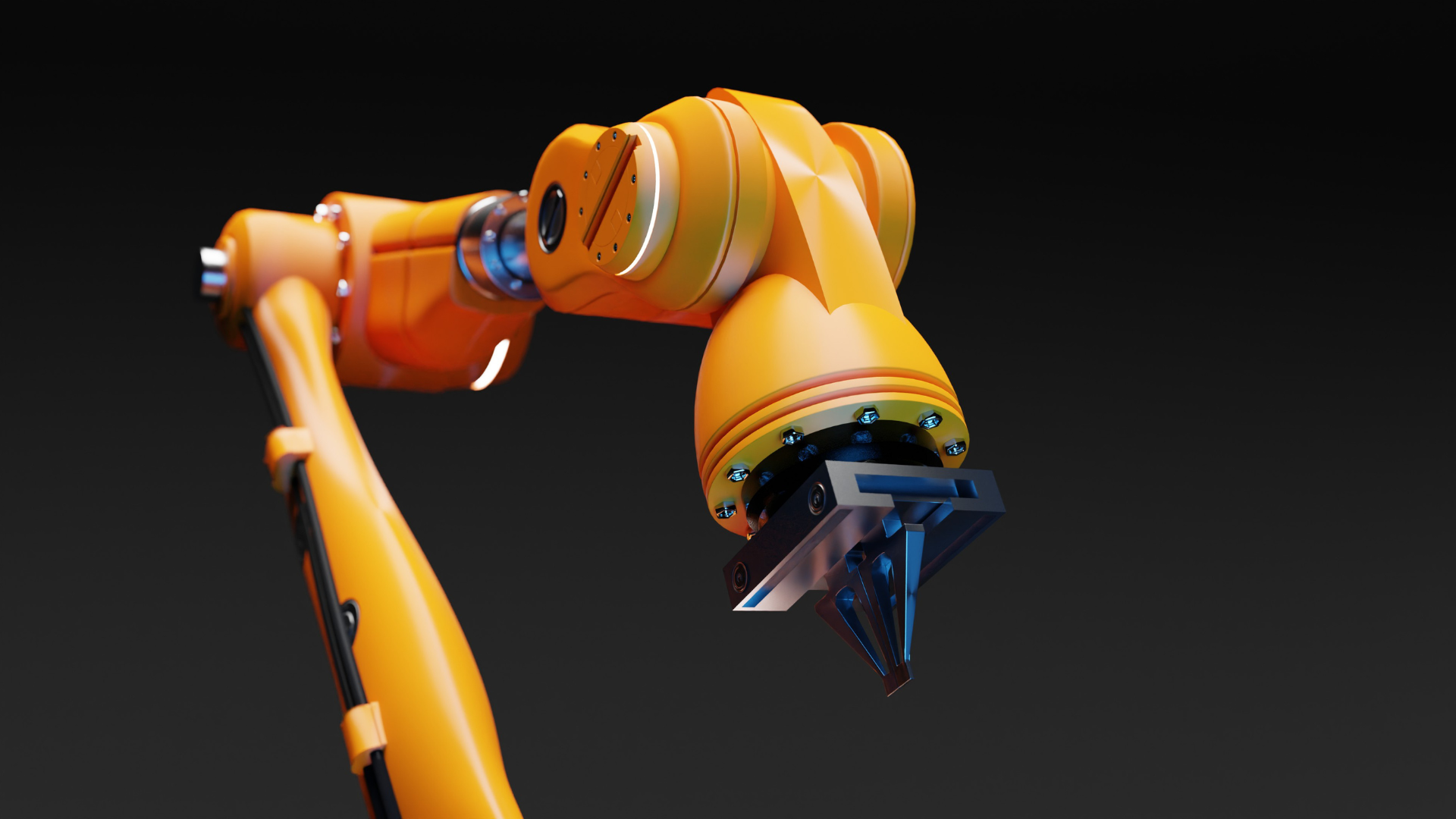

- Harness breakthrough technologies—AI, blockchain, robotics—to solve inefficiencies once considered unsolvable.

- Advance sustainability by enabling low-carbon, circular, and ESG-compliant supply chains.

Strategic Infrastructure & Growth-Equity

We target strategic growth-equity and infrastructure opportunities that enhance the resilience, connectivity, and efficiency of global supply chains. These are typically operating or development-stage assets where our capital, expertise, and network can accelerate build-out and long-term value creation.

Our focus is on assets that:

- Strengthen global supply-chain resilience through strategic location and design.

- Enable seamless multimodal transport and cross-border trade flows.

- Support high-compliance, high-value sectors with specialized infrastructure.

- Advance sustainable logistics through low-carbon and energy-efficient systems.

Advisory Services

Capital is just the starting point. Our advisory practice works with portfolio companies, strategic clients, and institutional partners to unlock growth, accelerate execution, and strengthen market positioning. We combine decades of freight-forwarding, 4PL, and infrastructure expertise with deep transactional experience—ensuring strategies are not just designed, but delivered.

Our focus is on advisory mandates that:

- Open new markets and build lasting commercial relationships.

- Support complex M&A and capital-raising initiatives.

Business Development & Market Entry

Go-to-market strategies, partner identification, and client acquisition.

M&A & Fundraising Support

Target sourcing, deal structuring, and investor outreach.

Whether embedded with a portfolio company or engaged by a global client, our advisory teams operate as an extension of your leadership—turning plans into results across industries and geographies.

Ready to put your company on our radar?

Submit a deck or data-room link via the form below. We review every qualified submission within 14 days and respond with next steps or warm introductions.